Here is how we are helping one client turn their highly appreciated home into a mortgage free retirement home and an investment property.

Would you be willing to put off the sale of your home for 2 years in order to be able to reinvest your proceeds and defer taxes on your sale?

This works especially well in a market (like our current market) where you may rather be a buyer than a seller.

In this case, the client isn’t quite ready to retire but is choosing to buy their future retirement home now while prices are good and they can qualify for a mortgage. They plan to rent out the new retirement home for a year or two until they are ready to retire. Once they retire, they will move into the retirement house, and convert their highly appreciated home into an investment property.

Here is the plan we have them on now:

Our client has a highly appreciated home, wants to defer taxes on the sale of their home and still be able to claim the Section 121 exclusion.

· Client paid $198,000 for their Sammamish home in 1989.

· Client invested $143,500 in improvements over the years and has the receipts:

New Kitchen, New master bath, new roof, new guest bath, added a fence, 2 decks, created a closet in the attic off the master bedroom, added a patio off the front porch

· Client’s house value today about $1,650,000.

· If they sold it, they would likely have to pay capital gains tax of about $135,300 as follows:

Sales Price: $ 1,650,000

Cost of Sale: $ 132,000

Purchase Price: $ 198,000

Improvements: $ 143,500

Gain on Sale $1,176,500

Section 121 Excl $ 500,000 (married filing jointly)

Taxable Gain $ 676,500

Cap Gains Rate: 20%

Tax on Sale: $ 135,300

Last year they bought a home in Florida for $579,000 that they hope to retire to someday, but for now, are renting the home to cover the costs.

When they decide to retire, they plan to:

1. Move into their Florida house and make it their new primary residence.

2. Convert their Sammamish house into a rental property for at least 2 tax seasons.

3. After 2 years of rental, but before 3 years of rental, sell the Sammamish house using a Section 1031 exchange.

4. Claim the Section 121 exemption on the sale of the Sammamish house and pull $500k of the proceeds tax free and pay off the loan on the Florida house.

5. Use the Section 1031 exchange on their sale to roll the remaining proceeds into a Delaware Statutory Trust or another rental property so it would continue as investment property for them.

After all that, they hope to end up with:

· A Florida home free and clear of all debts;

· About a $875,000 investment in a DST (currently yielding about 5% cash on cash) or another investment property.

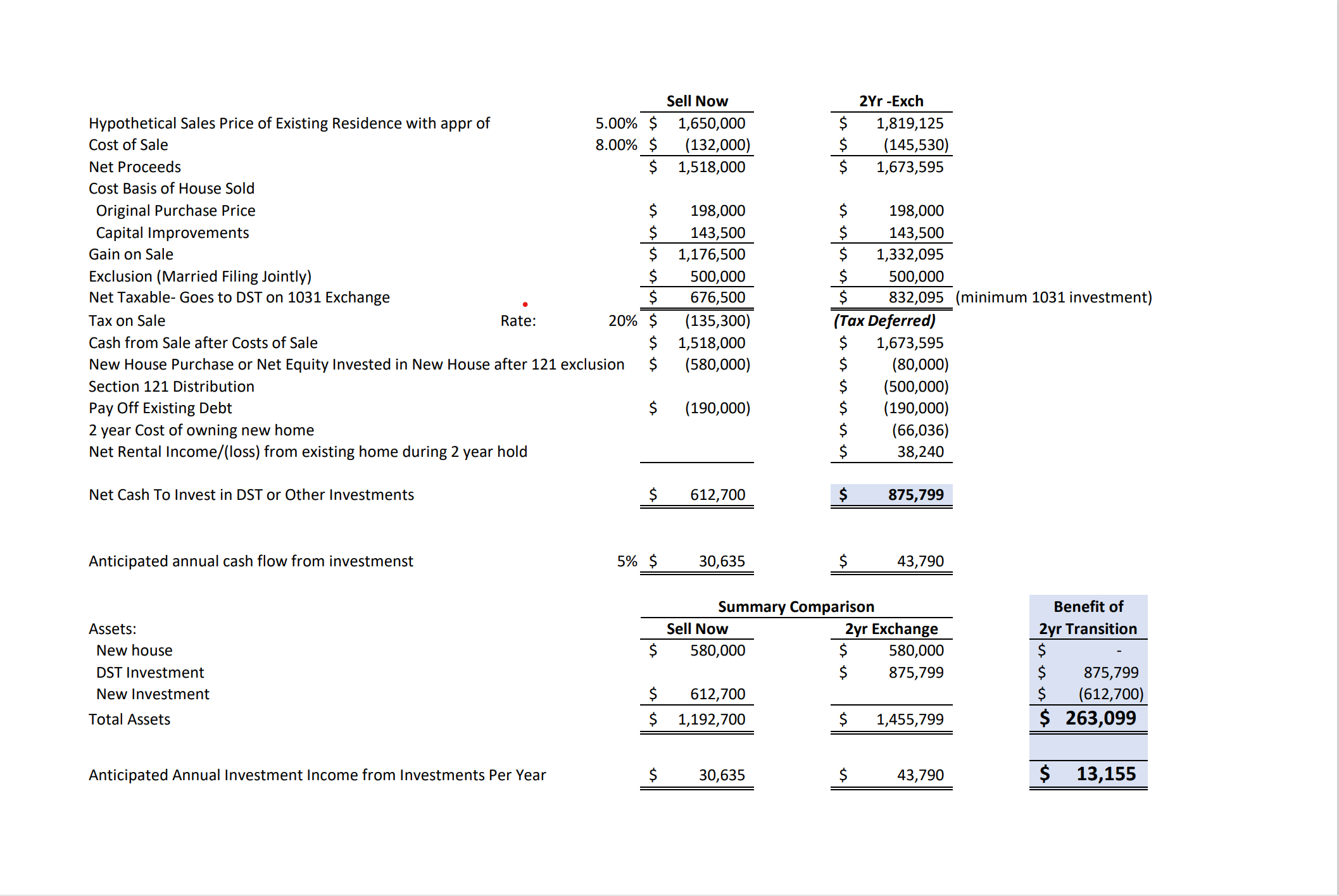

Look at the attached chart below to see an example they used to make their decision. It’s a side-by-side comparison for them showing the difference between Selling now and paying the taxes vs converting to an investment property and then exchanging into a DST in about 2 years.

Contact Bill Bastine at BillBastine@VORSellsHomes.com if you would to discuss this plan in more detail.

Please talk to your tax advisor before making any investment decisions. VOR Sells Homes is not a tax advisor and cannot give any tax advice.